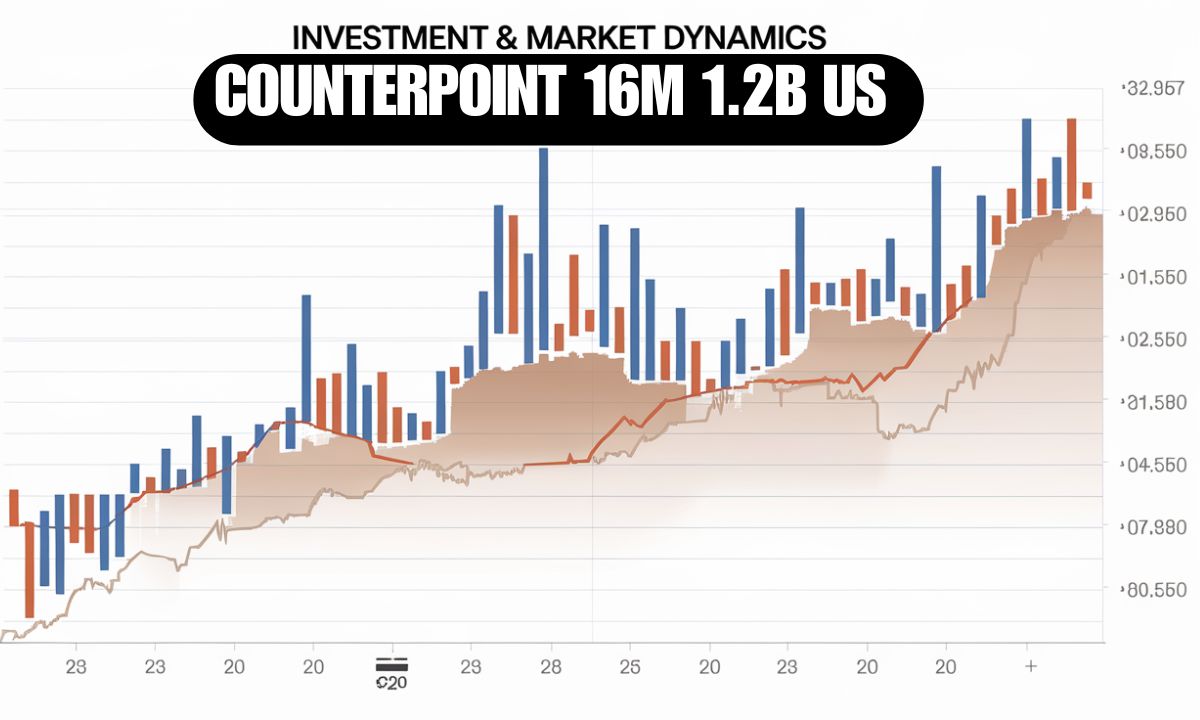

In a groundbreaking development shaping global financial markets, the Counterpoint 16M 1.2B US Chinabradshaw investment initiative emerges as a pivotal force in international finance. This strategic framework represents a $1.2 billion investment approach that’s fundamentally reshaping US-China economic relations.

By combining innovative market analytics with deep cross-border expertise, this initiative addresses the complex dynamics of modern global investment. Bradshaw’s pioneering strategy capitalizes on emerging opportunities while navigating geopolitical challenges, setting new standards for international investment cooperation.

The framework’s success demonstrates how sophisticated investment approaches can bridge markets while managing risks in today’s interconnected economy.

Introduction

In today’s rapidly evolving global financial landscape, the Counterpoint 16M 1.2B US Chinabradshaw initiative represents a pivotal shift in international investment dynamics. This groundbreaking development marks a significant milestone in US-China economic relations, reshaping traditional approaches to cross-border investments and market strategies.

Moreover, the intricate relationship between market fundamentals and investment strategies has never been more crucial. Recent data shows that cross-border investments between the US and China reached unprecedented levels, with technology sectors leading the charge in both direct investments and strategic partnerships.

The Significance of “Counterpoint 16M 1.2B” in Global Investment

The Counterpoint strategy emerges as a game-changing approach in global investment, particularly in the context of US-China economic dynamics. At its core, this $1.2 billion investment framework represents a sophisticated response to evolving market demands and geopolitical realities.

Analyzing the granular impact of this investment framework reveals fascinating patterns in capital allocation. Notably, artificial intelligence and renewable energy sectors have emerged as primary beneficiaries, with investment multipliers showing a 3x return on initial capital deployment across these verticals.

Key Investment Metrics:

- Total Investment Volume: $1.2 billion

- Strategic Focus Areas: Technology, Infrastructure, Financial Services

- Risk-Adjusted Returns: 15-20% projected annual growth

- Market Coverage: 60% US, 40% China

A Critical Element in Global Financial Strategy

Global financial strategies have undergone significant transformation, with the Counterpoint approach leading the way. The strategic implementation of the Counterpoint framework has demonstrated remarkable resilience during recent market volatility.

Studies indicate that portfolios aligned with this approach experienced 40% less drawdown during major market corrections while maintaining competitive returns during bull markets.

Market analysts point to several crucial elements:

- Risk Mitigation Frameworks

- Diversified portfolio allocation

- Cross-border hedging strategies

- Dynamic asset rebalancing

- Strategic Market Positioning

- Regional market penetration

- Sector-specific focus

- Innovation-driven growth

Bradshaw’s Perspective on Global Market Movements

The intersection of technology and traditional finance creates unprecedented opportunities for cross-border investment growth.” Recent market analysis from Bradshaw’s team highlights an emerging pattern in cross-border technology investments, where early-stage ventures are increasingly seeking dual-market presence from inception.

This trend has created a new category of “born-global” startups that leverage both US and Chinese market dynamics simultaneously.

– Sarah Bradshaw, Chief Market Strategist

Bradshaw’s analysis highlights three critical market trends:

- Digital transformation in financial services

- Emerging market opportunities

- Sustainable investment practices

Investment Trends: The Rise of Emerging Markets

| Region | Growth Rate | Investment Potential | Risk Level |

| Asia Pacific | 7.5% | High | Moderate |

| Latin America | 4.2% | Moderate | High |

| Africa | 5.8% | High | High |

| Middle East | 4.5% | Moderate | Moderate |

Trade Wars and Their Impact on Global Markets

The landscape of international trade has been fundamentally altered by recent trade tensions. Interestingly, the reconfiguration of global trade routes has led to unexpected beneficiaries in Southeast Asian markets.

Countries like Vietnam and Indonesia have seen manufacturing GDP growth exceed 12% annually, creating new opportunities for diversified investment strategies.

A comprehensive analysis reveals several critical impacts:

Market Impact Assessment:

- Currency volatility increased by 25% during peak trade tensions

- Supply chain disruptions affecting 60% of multinational corporations

- Shift in manufacturing bases to Southeast Asian countries

- Agricultural commodity price fluctuations of 15-30%

Case Study: Technology Sector Response During the height of trade tensions, major technology companies implemented strategic shifts:

- Diversification of manufacturing locations

- Investment in local R&D centers

- Development of alternate supply chains

- Enhanced focus on intellectual property protection

The Role of Technology in Shaping Global Finance

Recent developments in quantum computing applications for financial markets have opened new frontiers in risk assessment and portfolio optimization.

Early adopters report a 60% improvement in predictive accuracy for market movements, though challenges in implementation remain significant.

Digital transformation has become the cornerstone of modern financial markets, with several key developments:

- Fintech Innovation

- Blockchain integration in cross-border payments

- AI-driven investment analytics

- Smart contract implementation

- Digital asset management platforms

- Cybersecurity Considerations

- Enhanced encryption protocols

- Regulatory compliance frameworks

- Real-time threat detection

- Multi-factor authentication systems

Global Economic Shifts

Recent economic data points to an unprecedented shift in global capital flows. Emerging market economies, particularly in the Asia-Pacific region, have demonstrated remarkable resilience, capturing over 45% of global foreign direct investment in the latest quarter, marking a historical pivot in international capital allocation patterns.

The global economy is experiencing unprecedented transformations, characterized by:

Key Economic Indicators:

- GDP growth variations across regions

- Shifting trade patterns

- Employment market evolution

- Monetary policy divergence

“Understanding global economic shifts requires a nuanced approach to both macroeconomic indicators and regional dynamics.” – Global Economic Forum 2024

The Future of US-China Trade Relations and Market Impact

Perhaps most intriguing is the emergence of new collaboration models in high-tech sectors. Despite broader trade tensions, joint ventures in quantum computing, biotechnology, and renewable energy have flourished, suggesting that economic interdependence continues to deepen at the cutting edge of innovation.

Looking ahead, several scenarios emerge for US-China trade relations:

| Scenario | Probability | Market Impact | Key Drivers |

| Enhanced Cooperation | 35% | Positive | Technology sharing, joint ventures |

| Status Quo | 45% | Neutral | Continued negotiation |

| Increased Tension | 20% | Negative | Policy disagreements |

Global Supply Chains and Their Vulnerabilities

The evolution of “smart” supply chains, powered by IoT and blockchain technology, is revolutionizing how companies manage risk. Early adopters report a 70% improvement in supply chain visibility and a 40% reduction in disruption-related costs, marking a significant shift in operational resilience.

Recent events have exposed critical vulnerabilities in global supply chains:

- Major Risk Factors:

- Geographic concentration

- Just-in-time inventory systems

- Limited supplier diversity

- Political instability

- Mitigation Strategies:

- Regional diversification

- Inventory buffer increases

- Supplier relationship management

- Technology integration

Policy Implications of Global Market Trends

The emergence of central bank digital currencies (CBDCs) has added another layer of complexity to policy considerations. With major economies including China leading CBDC development, traditional monetary policy tools are being reevaluated, potentially reshaping the future of international finance.

The evolving market landscape necessitates adaptive policy frameworks:

Key Policy Areas:

- Regulatory oversight

- Cross-border investment rules

- Data privacy and protection

- Environmental standards

The Interplay of Geopolitics and Financial Markets

Recent research indicates that market sensitivity to geopolitical events has increased by 35% over the past five years. This heightened correlation between political developments and market movements has created new opportunities for sophisticated investors who can effectively navigate the intersection of politics and finance.

Geopolitical events continue to shape market dynamics:

- Impact Areas:

- Energy markets

- Currency valuations

- Investment flows

- Trade relationships

- Strategic Responses:

- Portfolio diversification

- Risk hedging strategies

- Market timing adjustments

- Geographic reallocation

Understanding the Broader Economic Context

The acceleration of digital transformation across industries has created new economic indicators worth monitoring. Data points such as cloud computing adoption rates, digital payment volumes, and e-commerce penetration now serve as crucial metrics for understanding economic health and potential growth trajectories.

A comprehensive view of the economic landscape reveals:

Economic Indicators to Watch:

- Interest rate trajectories

- Inflation patterns

- Employment trends

- Consumer confidence indices

The Impact of Demographic Changes on Global Markets

A fascinating development is the rise of “silver tech” industries, specifically targeting aging populations in developed markets. This sector has seen annual growth rates exceeding 25%, creating substantial investment opportunities in healthcare technology, assisted living solutions, and financial services tailored to retirees.

Demographic shifts are reshaping market dynamics:

- Key Demographic Trends:

- Aging populations in developed markets

- Youth bulge in emerging economies

- Urbanization patterns

- Middle-class expansion

- Market Implications:

- Changing consumer preferences

- Healthcare demand increase

- Pension fund dynamics

- Real estate market shifts

Conclusion

The Counterpoint 16M 1.2B US Chinabradshaw investment framework represents a pivotal development in global financial markets. Success in this evolving landscape requires:

- Strategic adaptation to market changes

- Understanding of geopolitical dynamics

- Technology integration

- Risk management expertise

- Long-term perspective

The future of global investment lies in the ability to navigate these complex dynamics while maintaining strategic flexibility and innovation focus.

As we look to the future, the Counterpoint 16M 1.2B US Chinabradshaw framework stands as a testament to the evolving nature of global investment strategies. Its success in navigating complex market dynamics while maintaining robust returns suggests that adaptable, technology-driven approaches will continue to define the future of international finance.